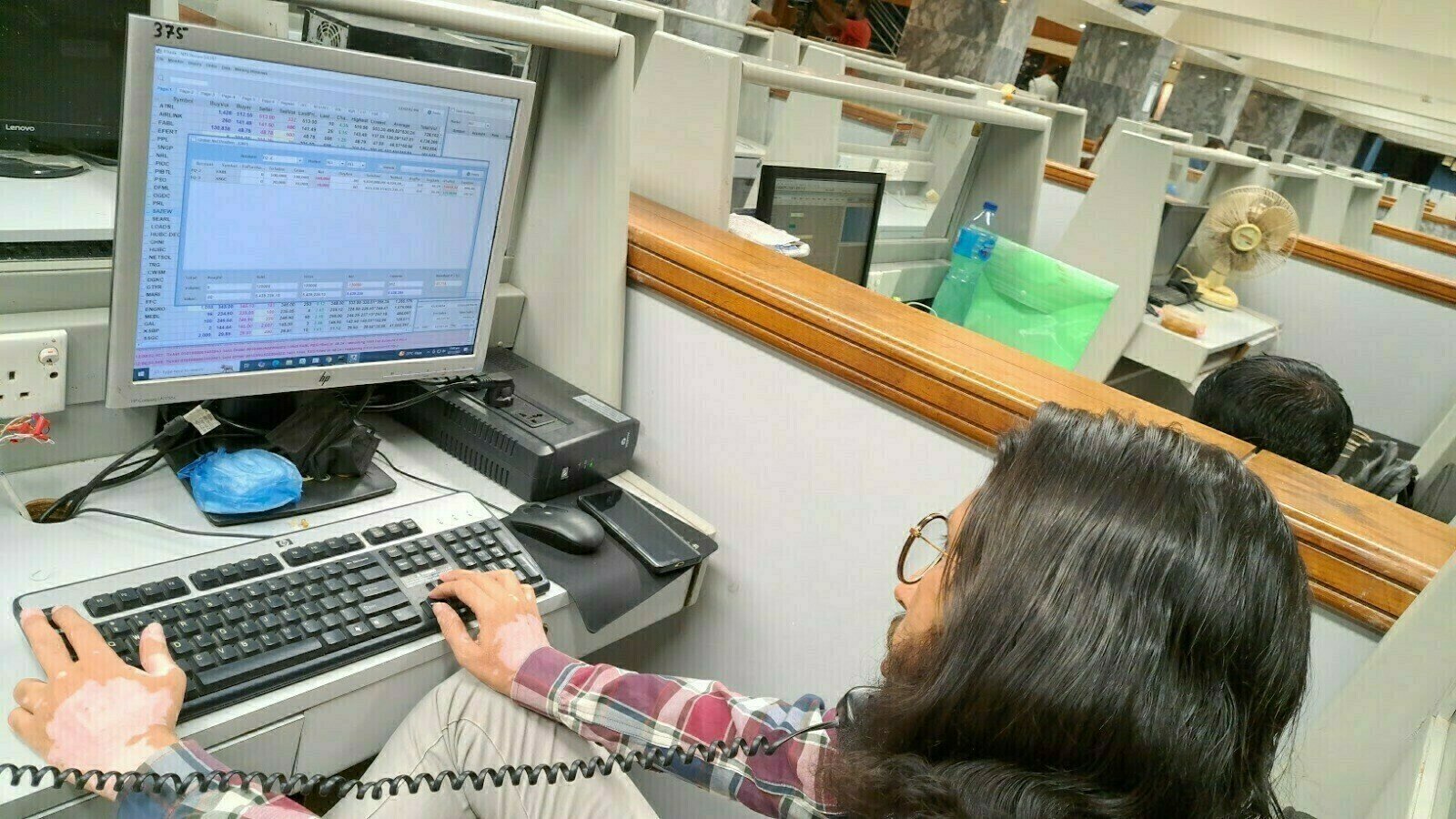

The Pakistan Stock Exchange (PSX) experienced a volatile session on Thursday, with the KSE-100 Index fluctuating in both directions before closing nearly unchanged.

The trading day started on a positive note as the benchmark index reached an intra-day high of 118,367.81 points. However, profit-taking in the latter part of the session wiped out most of the early gains, pushing the index to an intra-day low of 116,857.61 points. By the session’s end, the KSE-100 settled at 117,119.65 points, marking a modest increase of 111.57 points or 0.10%.

Factors Driving Market Movements

Analysts linked the initial buying momentum to improved macroeconomic indicators, such as a notable decline in inflation. This development has fueled optimism for potential policy rate cuts.

“CPI for December 2024 came in at an encouraging 4.1%, the lowest since April 2018, as macroeconomic stabilization under IMF directives gains traction,” noted Intermarket Securities.

The firm also highlighted that equities, particularly cyclicals, remain attractive investments as reduced interest rates gradually enhance consumption and industrial activity.

Data from the Pakistan Bureau of Statistics (PBS) released on Wednesday showed that headline inflation in December 2024 stood at 4.1% year-on-year, down from November’s 4.9%.

Topline Securities observed mixed investor sentiment, as some opted to book profits after recent market gains. “This created a divergence across sectors, with certain stocks under selling pressure while others maintained upward momentum,” it stated.

Sector and Stock Highlights

The market reflected a mixed trend, with notable activity in the banking sector. On the other hand, energy-related sectors, including oil and gas exploration companies, oil marketing companies (OMCs), and power generation firms, faced selling pressure.

Key index movers included HBL, JSBL, and MEBL, which closed in the green. Conversely, stocks like HUBCO, PSO, SNGPL, POL, OGDC, MARI, and PPL ended in the red.

Broader Market and Global Trends

On Wednesday, the PSX started the year on a strong note, with the KSE-100 gaining nearly 1,900 points to close above the 117,000 mark. However, Thursday’s global markets showed a mixed performance.

Asian stocks struggled for traction, reflecting caution among investors ahead of Donald Trump’s return to the White House and expectations of a more hawkish Federal Reserve policy. The MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.2% in December, despite a 7% annual gain for 2024. Early trading on Thursday saw the index drop another 0.5%, with volumes subdued due to Japan’s trading holiday.

Currency and Trading Volume Updates

The Pakistani rupee showed a marginal decline against the US dollar, depreciating by 0.03% in the interbank market. By close, the currency settled at 278.64, losing Re0.09 against the greenback.

Trading volumes on the all-share index increased to 1,037.86 million shares, up from 956.27 million shares on Wednesday. The value of traded shares also edged higher, reaching Rs46.57 billion compared to Rs46.44 billion in the previous session.

Fauji Foods Ltd led the trading volumes with 89.48 million shares, followed by WorldCall Telecom with 72.00 million shares, and Telecard Limited with 61.07 million shares. Out of 464 companies traded, 193 registered gains, 225 saw declines, and 46 remained unchanged.

https://maalikan.com/

https://btobservices.pk/

CyE kVjIdDdm oMIoXQ WKHuuvL